Cardano Price Prediction: A Comprehensive Guide for 2025 and Beyond

Cardano, with its ADA token, has become one of the most popular cryptocurrencies in recent years. As more investors are drawn to the digital asset world, many are curious about the Cardano price prediction and what lies ahead for Cardano's price forecast in the coming years.

This guide will cover ADA price predictions, how the Cardano price could evolve, the factors influencing its price movements, and the long-term potential of this innovative blockchain platform.

What is Cardano?

Cardano is a blockchain platform that aims to provide a more secure, scalable, and sustainable ecosystem for decentralized applications (dApps) and smart contracts. Its native cryptocurrency, ADA, is used for transactions within the Cardano network and serves as a stake in the platform's proof-of-stake (PoS) consensus mechanism.

The Cardano blockchain has gained significant attention for its scientific approach to blockchain development and its focus on academic research. Led by Charles Hoskinson, one of the co-founders of Ethereum, Cardano aims to address many issues that current blockchain platforms face, such as scalability, security, and sustainability.

Additionally, it is worth noting that Cardano does not build on top of technical foundations from Bitcoin or other blockchains. Instead, it works with leading academics on research to develop new and innovative solutions. Given Cardano's ambitious goals and the growing interest in cryptocurrencies, the question on many investors' minds is: "What is the Cardano price prediction for the next few years?"

1. Cardano's Technology and Upgrades

Cardano's continuous development is one of the key factors driving its price forecast. One of the most notable developments is the introduction of smart contracts on the Cardano network, which allows developers to build decentralized applications (dApps) on the platform.

Additionally, Cardano’s consistent upgrades, such as Hydra (scaling solution) and Mithril (light client protocol), improve blockchain efficiency, thereby attracting more developers and users. These upgrades can positively impact Cardano price movements, as the platform becomes more versatile and widely adopted.

2. Market Sentiment and Crypto Trends

The crypto market is highly volatile and influenced by market sentiment. Factors like the greed index, investor emotions, and overall crypto market trends can significantly impact the price of ADA.

Also, global events, regulations, and major partnerships can significantly affect investor sentiment. For instance, Alonzo’s launch triggered optimism and a price rally in 2021. It's also important to note that a bullish or bearish outlook for the cryptocurrency market can lead to significant price swings in ADA.

3. Cardano’s Market Capitalization

The market cap of a cryptocurrency plays an important role in its price prediction. This is because a higher market cap typically indicates more stability, while a smaller market cap can mean more volatility. For Cardano ADA, its market cap is an important indicator of its growth potential and its price movements.

4. Adoption and Real-World Use Cases

The Cardano network is designed to support decentralized applications, smart contracts, and even digital identity solutions. As more projects and businesses choose Cardano as their platform, the demand for ADA tokens could increase, potentially driving up the price of Cardano.

5. Global Regulatory Landscape

Cryptocurrencies face regulatory challenges in different countries. Changes in regulations can have a significant effect on the price of ADA, although positive regulatory developments, such as the recognition of Cardano as a legal asset, can encourage investment and increase its market value.

6. Technical Indicators

In addition to fundamental factors, technical analysis plays a key role in Cardano price predictions. Traders look at various indicators like support levels, resistance levels, moving averages, and the average price to predict future price movements. Technical indicators can also provide valuable insights into where the price of Cardano might head in the short term.

7. ADA’s Market Demand and Supply

Like any other cryptocurrency, the price of ADA is also determined by the supply and demand dynamics. If demand for ADA increases due to the network's growth or increased adoption, the price of ADA may rise. Conversely, if demand decreases, ADA's price could decline.

8. Macro-Economic Factors:

Broader market conditions, such as interest rates, inflation, and economic stability, also play a role in determining ADA’s price.

ADA Price Predictions for 2025 and Beyond

Now that we have an understanding of the factors influencing Cardano price movements, let's look at the ADA price forecast for the next few years.

Cardano price prediction 2025

In 2025, ADA’s price is expected to experience moderate volatility. The current Cardano price is subject to market conditions, sentiment, and technical factors. Also, given the Cardano blockchain’s focus on development and its ability to attract new users and dApps, Cardano ADA could see significant growth.

By 2025, various analyses suggest that ADA could experience significant growth. Some forecasts also predict that Cardano's price could reach approximately $2. Other analyses suggest a potential range between $1.81 and $2.42, with an average of around $2.12. These projections are based on factors such as technological advancements, increased adoption, and overall market trends.

Cardano Price Prediction for 2030

Looking ahead to 2030, analysts have varying opinions on ADA's potential value. Some forecasts suggest that ADA could reach a high of $5.50 by 2030. These predictions consider factors like Cardano's technological advancements, increased adoption, and the overall growth of the cryptocurrency market.

Cardano Price Prediction for 2040

Predicting prices for 2040 involves considerable uncertainty due to the dynamic nature of the cryptocurrency market. Some long-term forecasts suggest that ADA could reach approximately $10.62 by 2040, with potential for further growth in the following decade. However, these projections are speculative and depend on numerous factors, including technological developments, regulatory changes, and market dynamics.

Cardano Price Prediction for 2050

Looking even further ahead to 2050, any price predictions are highly speculative. Although some analyses suggest that ADA could reach higher price points by 2050, we are not certain about it due to the unpredictable nature of the market.

Cardano Price Prediction for the Next Bull Run

The timing of the next cryptocurrency bull run is uncertain, but many analysts anticipate significant market movements in the coming years. During such periods, ADA has the potential to experience substantial price increases. Some forecasts suggest that ADA could reach approximately $4.60 during the next bull market and this will likely be driven by the ongoing development and collaborations within the Cardano project.

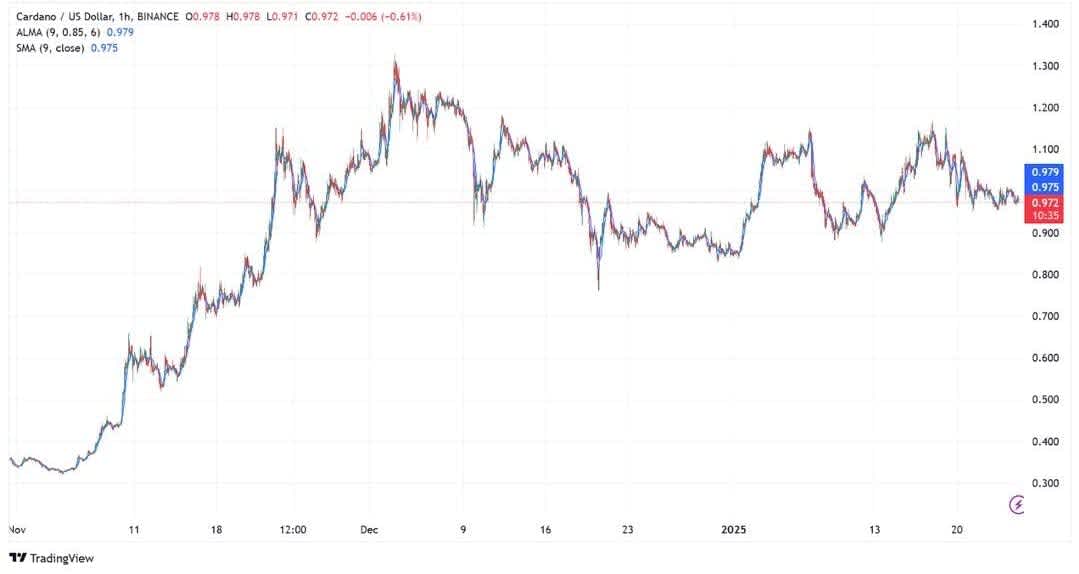

Technical Analysis for ADA Price

Here are some important technical indicators and analysis that could influence ADA’s price in coming times;

1. Moving Averages

The moving average (MA) is one of the most widely used technical indicators in cryptocurrency analysis. It helps smooth out price fluctuations by calculating the average price of ADA over a specific period. Short-term moving averages can help identify trends, while long-term moving averages provide insights into the overall market direction.

Moving averages help traders identify support levels and overall market direction. If the short-term moving averages cross above the long-term averages, it could signal a bullish outlook for Cardano. Conversely, a bearish trend could be predicted if the short-term MA falls below the long-term MA.

2. Support and Resistance Levels

Support levels are price points at which ADA tends to find buying pressure, preventing it from falling further. On the other hand, resistance levels are price points where ADA encounters selling pressure. Analyzing these levels can help investors predict future price movements.

For example, if ADA consistently finds support at $0.8, it may indicate that this level is a strong area of buying interest. Conversely, $1.2 might be a resistance level, where selling pressure is more significant.

3 Relative Strength Index (RSI)

The RSI is another important technical indicator that measures whether an asset is overbought or oversold. If Cardano ADA has an RSI above 70, it could indicate that the asset is overbought and may be due for a pullback. Conversely, an RSI below 30 suggests that ADA is oversold and could be a good buying opportunity.

4. Trading Volume

Trading volume is an important indicator of market interest and can provide insights into the strength of a price move. A price increase accompanied by high trading volume is usually seen as a strong move, while a price increase with low volume might signal that the move is weak and could reverse.

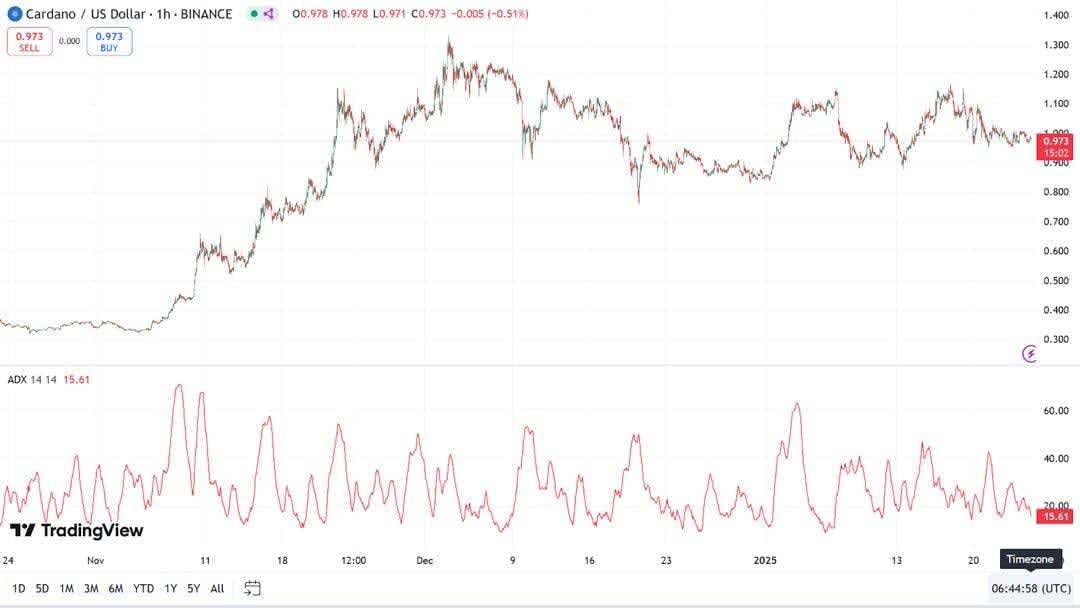

5. Neutral Average Directional Index (ADX)

The Neutral Average Directional Index measures the strength of a trend. A reading below 20 often suggests that ADA is in a weak or consolidating trend, while higher values signal stronger trends.

Key Considerations for ADA Investors

Before diving into an investment in Cardano, there are a few important points to consider:

1. Volatility of the Crypto Market

The cryptocurrency market is known for its volatility. Prices can swing dramatically in short periods, which means Cardano ADA could experience rapid increases or decreases in value. So, always be prepared for price fluctuations and ensure you're comfortable with this volatility if you plan on investing.

2. Cardano's Development Progress

As with any technology-based project, the future of Cardano depends largely on its development team and their ability to deliver promised upgrades and improvements. Cardano's network has made significant strides with the implementation of smart contracts, but continued progress is necessary for it to maintain its competitive edge.

3. Market Sentiment and News

The Cardano price movements are heavily influenced by the broader crypto market sentiment and the news cycle. Positive news regarding adoption, partnerships, or upgrades can lead to a surge in price, while negative news such as regulatory concerns or security breaches could dampen investor confidence. Staying informed about Cardano’s market sentiment is key to understanding potential price trends.

4. Regulatory Landscape

Global regulations for cryptocurrencies are still evolving and local regulations can impact the price of ADA significantly. So, if regulators adopt favorable policies toward cryptocurrencies and blockchain projects like Cardano, it could lead to price appreciation. Conversely, stricter regulations or bans could dampen growth and reduce the price of ADA. Monitoring regulatory developments in major markets is critical for ADA investors.

5. Diversification of Portfolio

While Cardano presents a promising opportunity, it’s important to remember that diversification is a key strategy in reducing risk. Putting all your funds into one asset, especially in a volatile market like the cryptocurrency market, can expose you to greater risk. It's wise to spread your investment across different assets in order to protect yourself against sudden price downturns.

Potential Risks in Investing in Cardano

Like all cryptocurrencies, Cardano presents risks that investors should be aware of:

1. Technology Risks

Even though Cardano has been built with a focus on scalability, sustainability, and security, the technology is still relatively new. As Cardano continues to grow and introduce new features, unexpected bugs or vulnerabilities could arise that impact the network’s functionality and, by extension, the price of ADA.

2. Regulatory Risks

Cryptocurrency regulations are still in flux across many regions. So, future regulatory crackdowns or bans could hinder Cardano’s adoption and decrease its value. Additionally, changes in tax policies or international restrictions could have an impact on both the market and Cardano price predictions.

3. Market Competition

Cardano is not alone in the blockchain space. Other projects like Ethereum, Solana, and Polkadot are also competing for dominance in decentralized applications and smart contract platforms. If Cardano fails to secure its position or cannot differentiate itself from the competition, it could limit its growth potential.

4. Adoption Challenges

While Cardano’s blockchain offers promising features, its success is contingent on the adoption of the Cardano network by developers, businesses, and users. This simply means that without widespread adoption, the price of ADA may struggle to grow.

The Future of Cardano: A Bullish or Bearish Scenario?

Bullish Scenario

In the bullish scenario, Cardano’s ADA token could see significant growth. If Cardano continues to expand its network with strong adoption of its smart contracts and decentralized applications, the price of ADA could reach new all-time highs.

Additionally, if the broader cryptocurrency market enters a bullish phase, Cardano could experience increased investment and interest, further pushing the price of ADA up.

Key factors in this best case scenario include:

- Expansion of the Cardano network

- Increased adoption by developers and businesses

- Positive regulatory developments

- Strong technical analysis suggesting upward momentum

In such a scenario, Cardano’s ADA could potentially exceed its current price and move into new price ranges, reaching $2 to $5 by 2026 and even higher in the long term.

Bearish Scenario

On the flip side, the bearish scenario could involve Cardano’s price stagnating or even declining. This could happen if the network fails to attract significant adoption, technological advancements fall behind competitors, or negative news impacts the market sentiment. A bearish trend in the broader crypto market could also drag down Cardano’s price along with other cryptocurrencies.

Key factors in a bearish scenario include:

- Slow or stagnated adoption of the Cardano blockchain

- Competitive pressure from other blockchain platforms

- Increased regulatory hurdles

- Negative market sentiment and a decline in crypto market prices

In this case, ADA price predictions could dip below current levels, and Cardano could face challenges in maintaining its market position.

How to Read Cardano Charts

Most traders use candlestick charts, which provide more information than a simple line chart.

Cardano traders also use a variety of tools to try and determine the direction in which the ADA market is likely to head next.

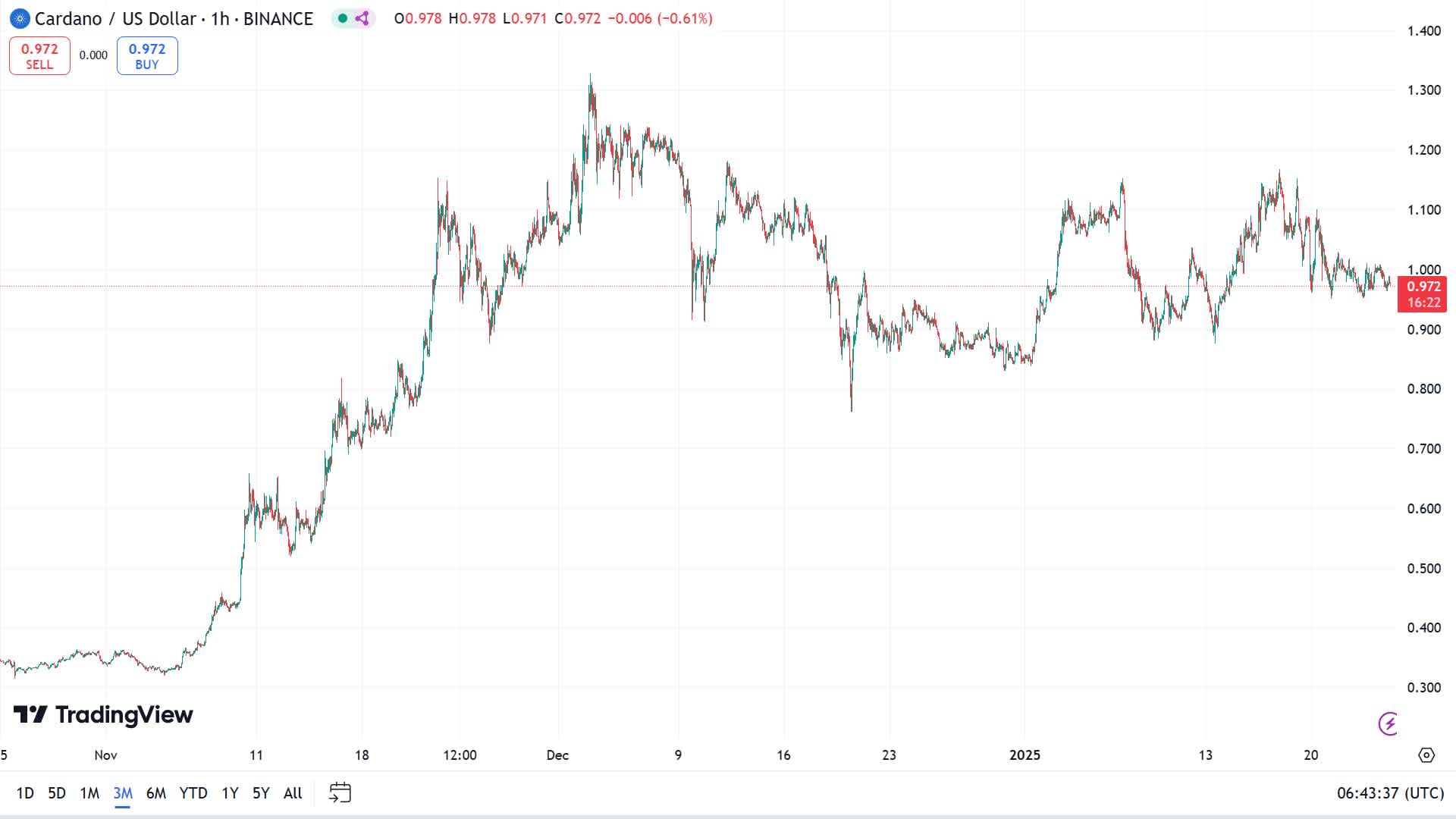

Current Price and Market Standing

As of today, Cardano’s (ADA) price is approximately $0.97. Its market position remains strong, ranking 9th among cryptocurrencies in terms of market capitalization.

Key Market Metrics

- Circulating Supply: 35.18 billion ADA tokens.

- Market Capitalization: $34.34 billion.

- Fully Diluted Valuation (FDV): $43.92 billion.

These numbers indicate Cardano’s status as a significant player in the cryptocurrency space, with strong investor confidence and wide adoption.

Historical Price Milestones

All-Time High (ATH):

Cardano’s ATH was achieved on September 2, 2021, when its price soared to $3.160 during a widespread cryptocurrency bull run.

This was driven by the launch of the Alonzo upgrade, which introduced smart contract capabilities to its blockchain, opening up new possibilities for decentralized finance (DeFi) and other applications.

All-Time Low (ATL):

ADA hit its lowest price of $0.017 on March 13, 2020, during a significant market crash triggered by the COVID-19 pandemic. This period was marked by fear and uncertainty, causing sharp declines across global markets, including cryptocurrencies.

Year-to-Year Performance:

- 2020: Cardano started gaining traction after the release of Shelley, which introduced staking rewards. Prices gradually climbed from $0.03 to $0.18.

- 2021: The year marked exponential growth as the Alonzo upgrade led to increased demand for ADA, reaching its ATH of $3.160.

- 2022: A bearish market hit, and ADA dropped to $0.24 by the end of the year due to market-wide corrections and macroeconomic pressures.

- 2023-2024: Cardano’s price remained stable between $0.30 and $1.0 with periodic spikes as developments like Hydra scaling solutions gained attention.

Market Cap and Valuation

Cardano's market cap of $34.34 billion reflects its vast ecosystem and significant adoption by users, developers, and institutions. The Fully Diluted Valuation (FDV) of $43.92 billion for Cardano (ADA) represents the estimated total market value of the cryptocurrency if all possible ADA tokens were in circulation.

Fear & Greed Index:

- Current Value: 75 (Extreme Greed)

This index is a composite measure of market sentiment, incorporating volatility, trading volume, and social media trends.

Why Is Cardano Gaining Popularity?

Cardano’s Unique Features

The Cardano network stands out due to its environmentally friendly proof-of-stake (PoS) mechanism and rigorous peer-reviewed protocols. These innovations ensure scalability without compromising security.

Significant Growth in Adoption

As more developers build on Cardano, its ecosystem continues to expand, leading to growth in ADA demand. Recent upgrades have also reduced transaction fees and increased throughput, making the platform attractive for decentralized applications.

Cardano vs. Other Cryptocurrencies

Cardano often competes with Ethereum, Solana, and Polkadot. However, its focus on sustainability and academic rigor gives it a competitive edge. Compared to Ethereum, Cardano's lower market cap suggests room for significant growth in the long term.

Cardano’s Future in the Cryptocurrency Market

- Potential ROI: ADA is expected to deliver significant growth in the coming years, with some analysts forecasting a 10x increase in average price.

- Market Capitalization: Cardano's market cap remains relatively low compared to Ethereum, indicating room for growth.

- Investment Advice: ADA offers potential, but consider diversifying across other assets.

Cardano Price Predictions FAQ

Q1: Is Cardano a good investment?

A: Cardano has strong potential for growth, but like all cryptocurrencies, it comes with risks. The price of ADA is influenced by market trends, adoption, and technological advancements. Conducting own research and seeking independent professional consultation is essential before making any investment decisions.

Q2: What is the current Cardano price?

A: Cardano’s current price fluctuates based on market conditions, but this cryptocurrency is currently trading at $0.97 per ADA/USD. You can also check the daily charts on platforms like TradingView, CoinGecko, and CoinMarketCap to keep up on the latest data.

Q3: What factors could lead to a rise in the price of ADA?

A: The price of ADA can rise due to factors such as increased adoption, successful upgrades to the Cardano blockchain, positive market sentiment, and a bullish scenario in the broader crypto market.

Q4: Should I buy Cardano now?

A: Whether to buy Cardano now depends on your investment strategy and the current sentiment in the market. If you believe in the long-term potential of Cardano, it might be a good buying opportunity, but as with any investment, it’s important to consider your financial goals and risk tolerance. Furthermore, it is always recommended to do your own research and consult with a financial advisor before making a decision.

Q5: What is the Cardano price forecast for the next 5 years?

While it’s impossible to predict the future with certainty, many experts are optimistic about Cardano’s long-term potential. If Cardano continues to grow its ecosystem, attract more developers, and expand its use cases, the price of ADA could see significant appreciation over the next 5 years. A common Cardano price forecast suggests ADA could reach anywhere between $2 to $5 by 2026, with further gains possible if adoption increases.

Conclusion: What’s the Best Move for Investors?

As we’ve explored in this article, Cardano price predictions vary depending on market trends, technological developments, and broader economic factors. While the long-term outlook for Cardano is generally positive due to its innovative blockchain and smart contract capabilities, Cardano’s price will ultimately be shaped by both internal progress and external market forces.

For those interested in buying Cardano (ADA), it’s important to stay informed, conduct research, and understand both the opportunities and risks associated with the cryptocurrency market. Additionally, Cardano could offer a good buying opportunity if you believe in the long-term potential of the project.

However, ensure that you are well-prepared for the inevitable price fluctuations and market volatility that come with investing in cryptocurrencies. So, if you're new to crypto investments, consider seeking independent professional consultation to help navigate this complex and fast-moving market.