Five Bitcoin Mining Stocks To Watch in 2025

Top Bitcoin Mining Stocks for Big Returns

Key Takeaways:

- Bitcoin Mining Stocks like Marathon Digital Holdings (MARA) and Riot Platforms (RIOT) offer the potential for scalable growth and dividends.

- Bitcoin's price volatility remains a key risk for direct investment interest and mining stocks.

- Diversifying between Bitcoin and mining stocks allows investors to balance risk and potential return, benefiting from both price appreciation and mining profitability.

The Bitcoin mining hardware market is currently valued at $11.15 billion, projected to reach $69.10 billion by 2034, growing at a compound annual growth rate (CAGR) of 22.46%. Meanwhile, the overall Bitcoin mining market size is forecast to reach nearly $8.24 billion by 2034, with a CAGR of 12.9%.

As Bitcoin's price continues to go up, mining rewards become more lucrative, attracting more miners to the industry. On February 20, 2025, Bitcoin miners collectively earned $40.19 million in revenue.

With the mining industry rapidly growing from the development of distributed ledger technologies and an increase in electronic venture capital investment, investors are now looking beyond hardware and direct mining operations. Many are now turning towards Bitcoin mining stocks as an alternative way to exposure to the sector, without needing to purchase expensive mining rigs or manage operations.

But how do these stocks compared to traditional BTC mining, what are the risks, and what are the top crypto mining stocks right now?

How Bitcoin Mining Works

Bitcoin operates on the Proof of Work (PoW) consensus model. Miners compete to solve complex mathematical puzzles using computational power. The first miner to find the correct solution adds a new block to the blockchain and earns Bitcoin as a reward. This system ensures security, decentralization, and fraud protection, keeping Bitcoin running without a central authority running the show.

When Bitcoin first launched in 2009, miners received 50 BTC per block as a reward. However, every four years, the network undergoes a Bitcoin halving event, reducing the mining reward by half. This built-in mechanism controls Bitcoin's supply and contributes to its scarcity, making mining rewards more valuable over time.

Pros & Cons of Investing in Bitcoin Mining Stocks

| Risk Analysis | Pros | Cons |

|---|---|---|

| Profitability | Mining stocks offer a high potential ROI, especially in a bull market. As crypto market capitalization increases, mining stocks appreciate | Stock performance heavily relies on Bitcoin’s market price, making them vulnerable to price fluctuations |

| Exposure to Bitcoin | Benefit from crypto gains without directly trading or mining | Governments may impose restrictions, creating regulatory uncertainty |

| Scalability | Mining companies operate at larger scales than individual miners | High operational costs, hardware failures, and market competition can impact profitability |

| Dividend Potential | Some mining firms distribute earnings as dividends for passive income as well as capital gains | Mining stocks can be more volatile than Bitcoin itself, reacting sharply to market news |

| Tax Advantages | Stock investments may qualify for tax benefits that direct Bitcoin holdings do not, depending on jurisdiction | Uncertain tax regulations in different countries may impact investment returns |

Top Bitcoin Mining Stocks

MARA Holdings (NASDAQ:MARA)

Marathon Digital Holdings, formerly known as Marathon Patent Group, is a prominent Bitcoin mining company based in North America. The company’s current hash rate exceeds 53.2 EH/s (exahashes per second). In January 2025, Marathon produced 750 Bitcoins, bringing its total holdings to 45,659 BTC.

- Quarterly Revenue Growth (YoY): 34.50%

- Market Cap: $5.36 billion

- Location: United States

- Hash Rate Capacity: 52.3 EH/s

- MARA Stock Forecast (1-Year): $27.01

The price of MARA crypto mining stock is currently trading within a symmetric triangle pattern. As of now, Marathon Digital Holdings' price is touching its support level. If this support level is not respected, the price could drop further to $13. However, if a reversal occurs, the 2025 price target for MARA is $27.

Riot Platforms (NASDAQ:RIOT)

Riot Platforms (RIOT), formerly known as Riot Blockchain, is one of the largest Bitcoin mining companies in North America. Riot Platforms hosts Bitcoin mining equipment, with large-scale mining facilities with significant scalability.

As of Q2 2024, Riot reported a self-mining hash rate exceeding 12 EH/s (exahashes per second). The company is known for its low-cost mining operations, with a maximum operational hash rate. Riot's Bitcoin production reached 516 Bitcoins in December 2024.

- Quarterly Revenue Growth (YoY): 63.40%

- Market Cap: $3.98 billion

- Location: United States

- Hash Rate Capacity: 28.2 EH/s

- RIOT Stock Forecast (1-Year): $18

On the weekly chart, the price of RIOT is rising above its trendline support. The price is expected to rise to the resistance level of $18, where it last traded in December 2023. If there is a clear breakout, further upside is anticipated for this year.

CleanSpark (CLSK)

CleanSpark is a US-based crypto mining company that focuses on utilizing renewable energy sources to power its Bitcoin mining data centers and facilities, aiming to reduce carbon footprints.

According to CleanSpark’s Fiscal Year First Quarter 2025 report, the company’s quarterly revenue surged to $162.3 million, marking a 120% increase compared to the previous year. The company also reported a quarterly net income of $241.7 million and a basic EPS of $0.85. The marginal cost per coin decreased by 6%, bringing it to approximately $34,000 at their owned facilities.

- Quarterly Revenue Growth (YoY): 120%

- Market Cap: $2.78 billion

- Location: United States

- Hash Rate Capacity: 40.1 EH/s

- CLSK Stock Forecast (1-Year): $20

Bitcoin miners are becoming more active as we enter the bull market. Crypto investors are driving the price of Bitcoin higher, which is having a positive effect on the price of crypto mining stocks like CLSK. The stock is showing clear signs of reversal, currently retesting the resistance lines of the 100 and 200 EMA on the weekly chart. The price target for CLSK in 2025 is $20.

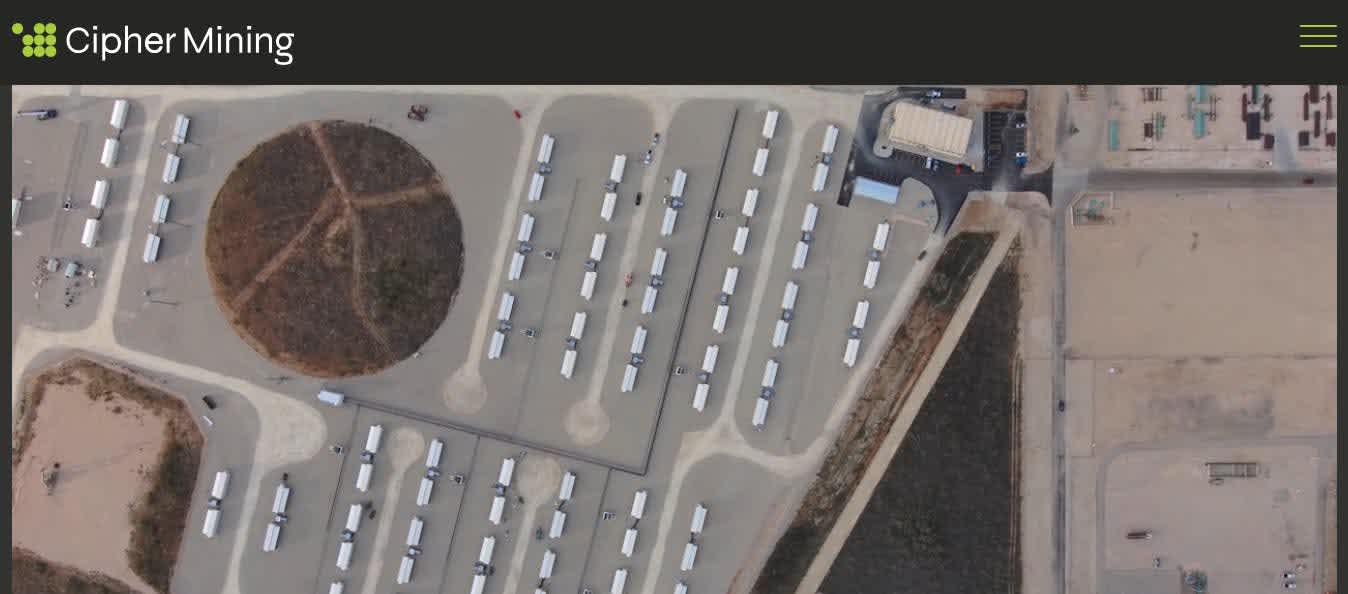

Cipher Mining (NASDAQ: CIFR)

Cipher Mining Inc. is another US-based crypto mining company, specializing in Bitcoin mining services. As of December 2024, the targeted hash rate for Cipher's mining facilities reached 13.5 EH/s, with plans to expand it to 35 EH/s.

The company uses Canaan A1566 Miners to support its high-performance computing operations. Cipher’s mining facilities primarily operate on renewable energy sources to mitigate the high energy costs associated with its industrial-scale ecosystem.

- Quarterly Revenue Growth (YoY): -20.5%

- Market Cap: $2.11 billion

- Location: United States

- Hash Rate Capacity: 10.7 EH/s

- CIFR Stock Forecast (1-Year): $9.2

CIFR is currently trading at $6, with the trading volume expanding above the trendline. Cipher Minig's economic outlook suggests a continuation of the current setup, with a potential price increase to $9.2 in 2025. If the Bitcoin's price keeps growing, the crypto mining companies trading stocks will likely attract US crypto investors seeking slightly safer investment options while still benefiting from the crypto's volatility.

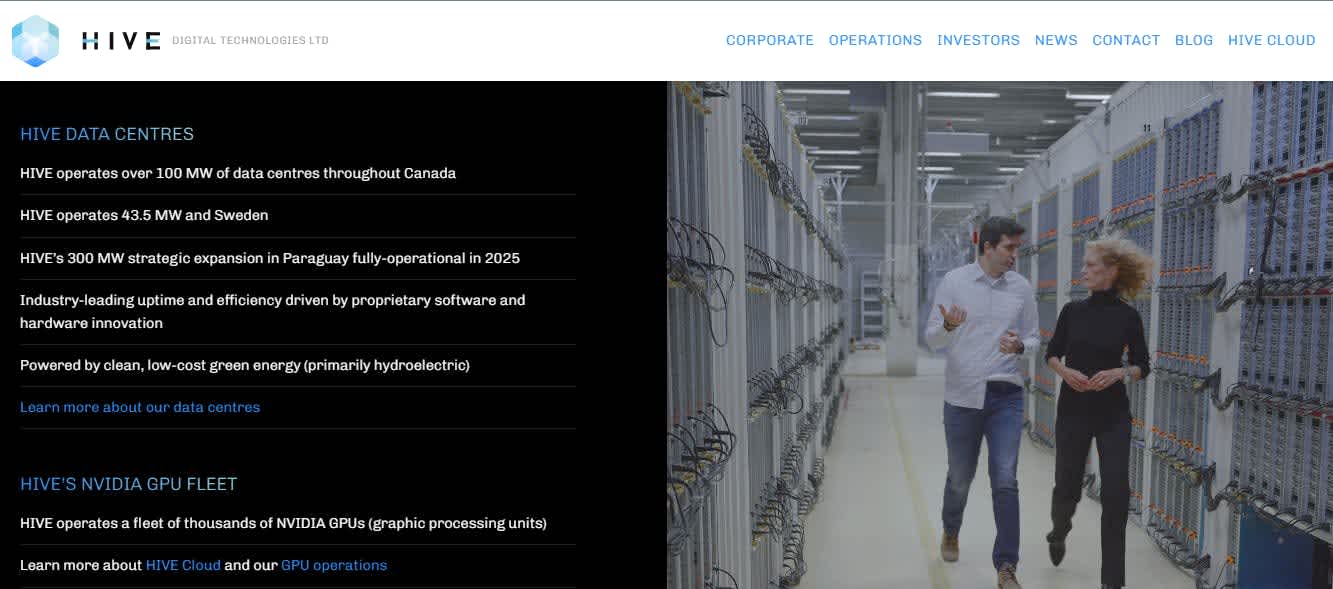

HIVE Digital Technologies (TSXV: HIVE)

Hive Digital Technologies Ltd. is a Canadian-based cryptocurrency mining company specializing in eco-friendly operations. As of January 2025, HIVE has achieved an operational hash rate of 6.0 EH/s (exahashes per second). The company plans to expand its global hash rate to 15 EH/s by the end of 2025.

- Stock Price (YoY Change): $2.69 (-51.0%)

- Market Cap: $423.88 million

- Location: San Antonio, Texas, USA

- Hash Rate Capacity: 6.0 EH/s (as of January 2025)

- HIVE Stock Forecast (1-Year): $8.08 (+200.37%)

Distributed ledger technologies have introduced a new class of assets: Bitcoin. HIVE’s stock price has been in a downtrend and is currently moving within a range zone above the support level. For a clear sign of reversal, the price needs to break above the local resistance of the EMA 200 on the weekly chart. A breakout pattern above the previous high would bring the price closer to the forecasted target of $8 in 2025.

Should You Buy Bitcoin Miners Stocks or Invest in Bitcoin?

The answer to this question isn't straightforward, as it depends on individual risk tolerance, investment habits, and regulatory considerations. Investing in Bitcoin mining stocks has its perks. Cryptocurrency mining companies often see huge gains during Bitcoin bull markets due to operational scaling.

Moreover, as Bitcoin mining stock prices rise, investors may also receive dividends as passive income. However, factors like energy costs, hardware maintenance, and regulatory shifts can impact returns.

Compared to publicly traded cryptocurrency miner stocks, investing directly in Bitcoin is relatively straightforward. Holding Bitcoin offers asset liquidity since it can be quickly bought or sold on hundreds of exchanges. The downside, however, is the security of digital assets and regulatory considerations.

Both the global cryptocurrency mining market and direct Bitcoin investment are volatile, meaning investing in either exposes you to a similar level of risk. Therefore, your choice should align with your risk tolerance, market outlook, and preference for operational involvement.

Conclusion

Bitcoin mining stocks offer a great opportunity to generate passive income through traditional stocks while benefiting from the cryptocurrency market’s growth. These stocks offer dividends and potential appreciation as the price of Bitcoin rises. In high-risk investment areas like this, diversification is key to offsetting risk and increasing potential returns. As always, though, DYOR (Do Your Own Research) and seek investment advice before making any financial investments.